pay mississippi state taxes by phone

John is filing as a single taxpayer in Mississippi. If someone makes less than 5000 they pay a minimum.

States With The Highest Lowest Tax Rates

Mississippi has a graduated individual income tax with rates ranging from 400 percent to 500 percent.

. Taxpayers must pay personal income tax to the federal government 43 states and many local. Taxpayers must pay personal income tax to the federal government 43 states and many local municipalities. The 2020 Mississippi State Income Tax Return forms for Tax Year 2020 Jan.

Mississippis income tax ranges between 3 and 5. You will need your Social Security Number to get information about your refund. Pay mississippi state taxes by phone Friday April 15 2022 Edit.

Pay Mississippi State Taxes By Phone phone state taxes Edit. An instructional video is available on TAP. For information on your tax refund 24 hour refund assistance is available touchtone phones only.

His annual taxable income is 23000. Credit or debit cards. Jefferson city 35 and kansas city 4875 local business license tax.

Mississippi State Income Tax Forms for Tax Year 2021 Jan. Pay directly from a checking or savings account for free. The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022.

You can make electronic payments for all tax types in TAP even if you file a paper return. Pay by credit card or. Pay your taxes by debit or credit card online by phone or with a mobile device.

The Mississippi state tax rate is graduated and are the same for individual filers as well as businesses. Lets take a look at an example provided by the Mississippi Department of Revenue. 31 2020 can be e-Filed together with the IRS Income Tax Return by the April 15 2020.

The tax rates are as follows. 0 on the first 2000 of taxable income. Here is a complete overview of all state related income tax return links.

The 2020 Mississippi State Income Tax Return forms for Tax Year 2020 Jan. 313 rows Since 2003 the average state-local sales tax rate has increased by 088 percentage pointsfrom 687 percent to 775 percent. Details on how to only.

Detailed Mississippi state income tax rates and brackets are available on. Mississippi also has a 400 to 500 percent corporate income tax rate. Ssn tax year form type filing status.

During that same period wireless taxes. Cre dit Card or E-Check Payments. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

The state uses a simple formula to determine how much someone owes.

Business Leaders Across Mississippi Call For Income Tax Elimination Now Mississippi Politics And News Y All Politics

Ar Ms Tn Sales Tax Holidays What You Need To Know Localmemphis Com

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Cell Phone Taxes And Fees 2021 Tax Foundation

But How Will We Fund Government Without Income Taxes

How High Are Cell Phone Taxes In Your State Tax Foundation

Mississippi Department Of Revenue Issues Updated Covid 19 Guidance Extended Deadlines Telework Nexus Forbearance Cooking With Salt

Mississippi Income Tax Cut Grocery Tax Reduction

How To Register For A Sales Tax Permit In Mississippi Taxvalet

Mississippi Tax Rate H R Block

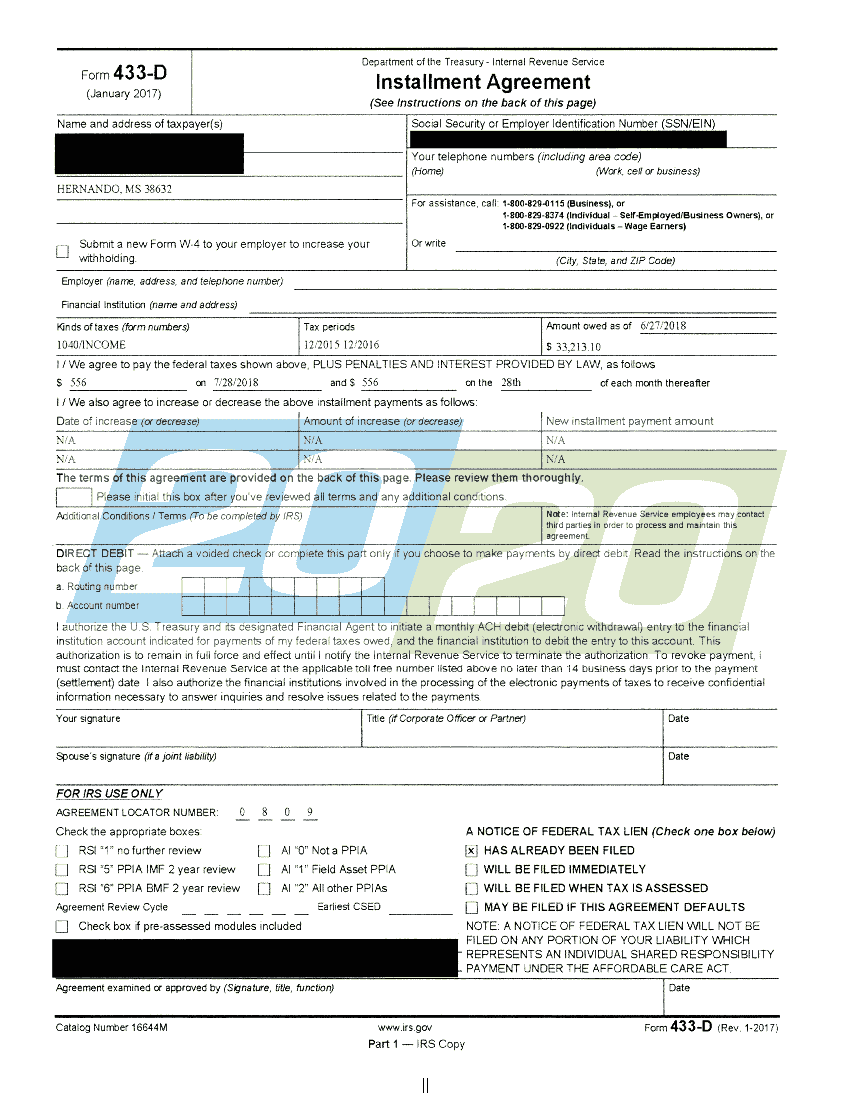

Tax Issues Resolved In Mississippi 20 20 Tax Resolution

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Mississippi Llc Tax Structure Classification Of Llc Taxes To Be Paid

Study House Tax Proposal Increases Burden On Poor Mississippians Mississippi Today

Study House Tax Proposal Increases Burden On Poor Mississippians Mississippi Today

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

As More Americans Move To No Income Tax States More Lawmakers Move To Phase Out State Income Taxes